PocketGuard

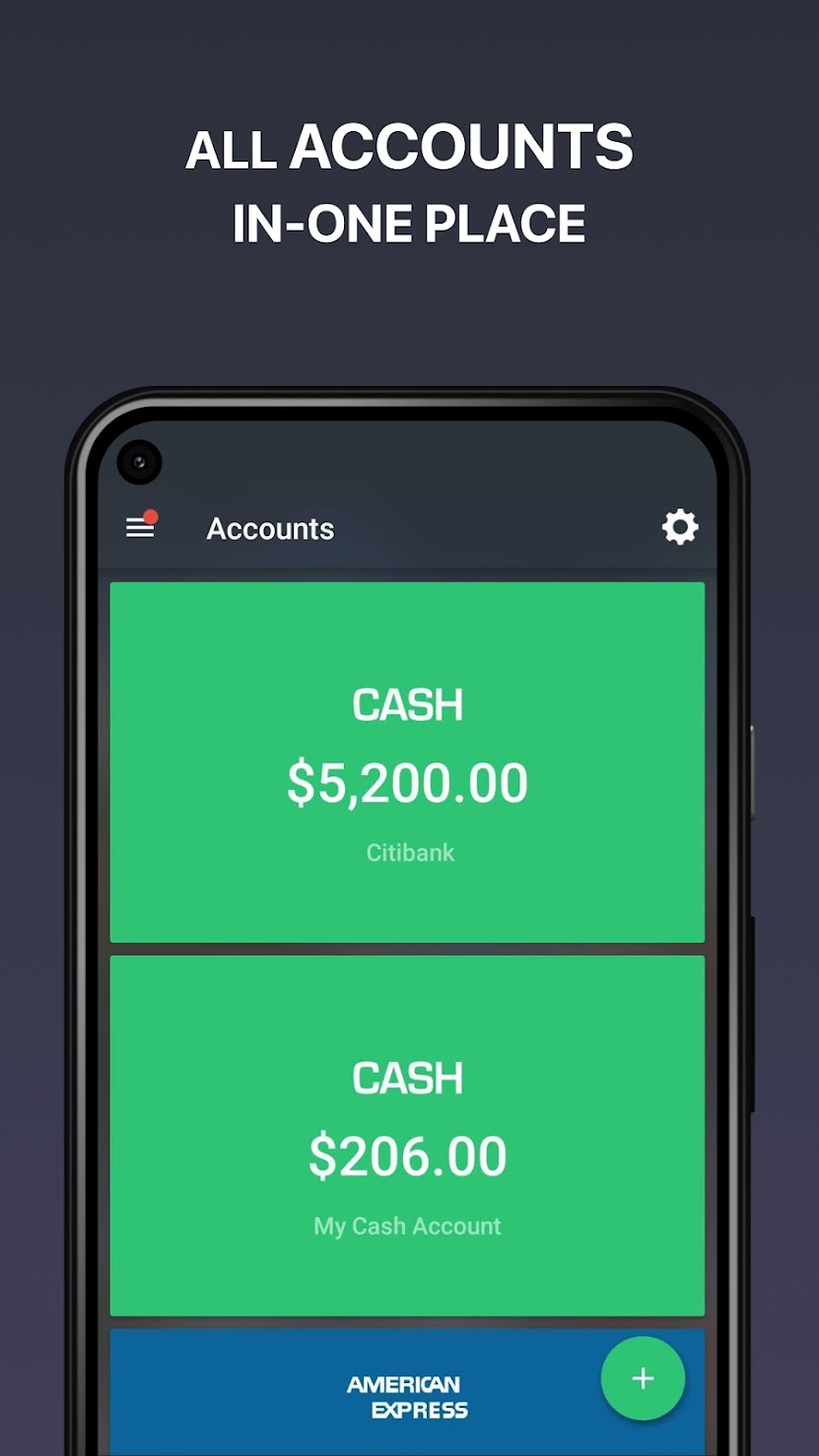

PocketGuard is developed for users who want to better manage their monthly budgets. You may use the app to track your purchases. Your purchases will then automatically upload.

The software allows you to set savings goals and track your progress towards them.

If you prefer spreadsheets for your budgeting, PocketGuard Plus users can export transactions directly to Microsoft Excel.

Users can also get customised offers on things like cable and cell phone service when they fill out their profiles. The program also tracks subscription services in your budget to guarantee you aren’t overpaying. These are fantastic features that can help users save money.

Because you’ll be entering and sharing sensitive financial data, utilize budgeting apps that are appropriately secured.

PocketGuard uses 256-bit SSL encryption, the same degree of security used by many financial institutions. It is additionally protected by biometrics and a PIN code in case your phone is stolen.

PocketGuard has two plans: the free version and PocketGuard Plus, a premium subscription.

The app is free to download and use in many ways. The commercial version, PocketGuard Plus, offers capabilities including exporting transactions, limitless budgeting objectives and categories, and transaction splitting.

PocketGuard Plus costs $7.99 per month, $79.99 per year, or $99.99 for a lifetime membership when upgrading from iOS or Android. Spending money on budgeting may seem counterproductive, but if an app works for you, the investment may be worthwhile.

Description

PocketGuard is a free budgeting program designed for users who wish to stay on top of their financial obligations. Smart algorithms make personal finance simple, which means that budgeting with Pocket Guard is so straightforward. That you won’t have to spend your entire life crunching numbers. To make sure that every dollar is properly tracked. We handle all of the procedures, such as spending tracking and bill monitoring. So that you can devote your time and attention to money management activities.

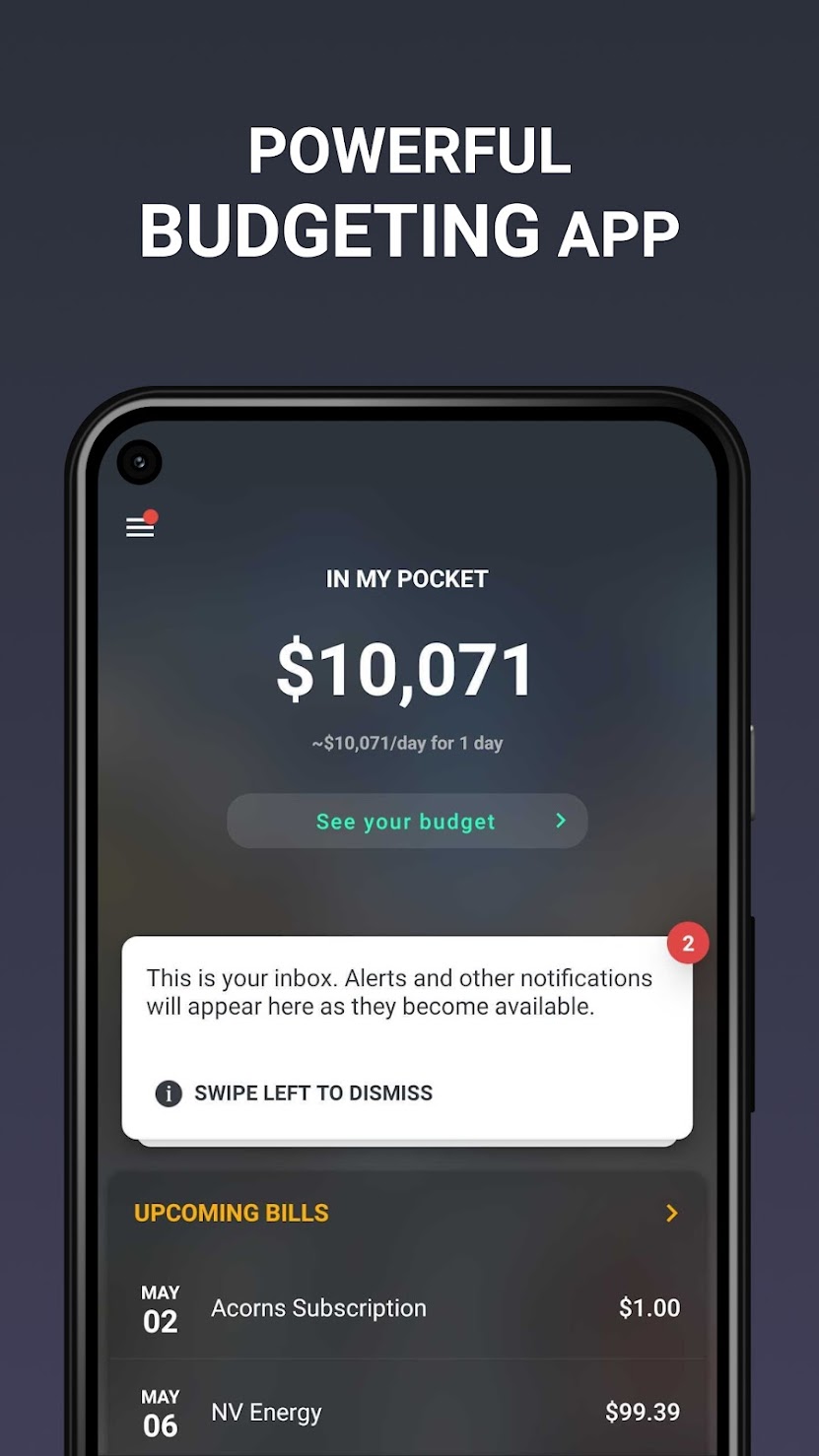

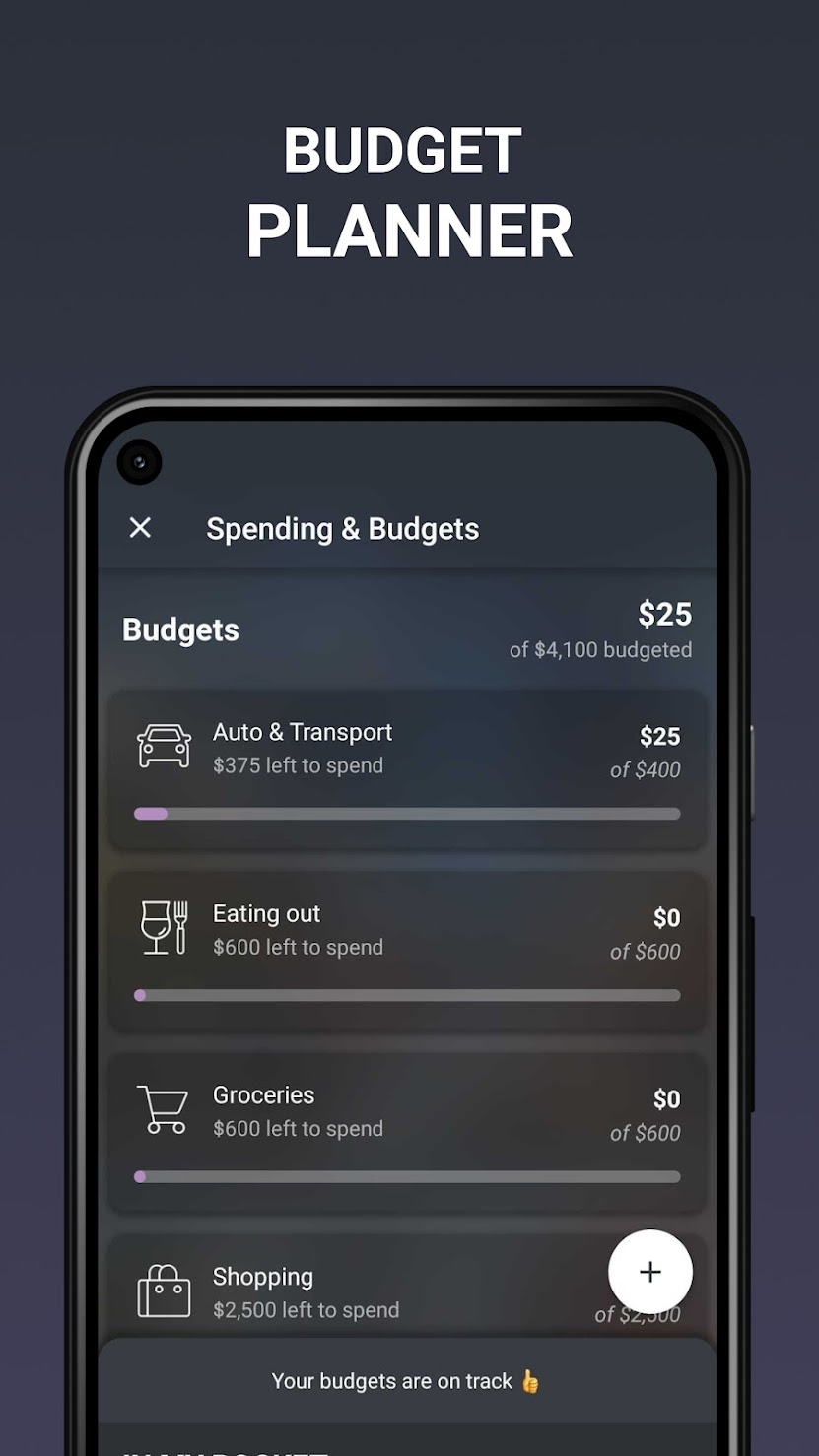

Always be aware of what you have in your pocket! In its most basic form, a budget is the gap between revenue and expenditure. If the answer is affirmative, you are doing well. In every other instance, the budget is out of balance and needs to be addressed immediately. It’s at this point that the “IN MY POCKET” feature comes into play. Which is a combination of a cost tracker, a bill tracker, and a budget planner. It’s at this point that the “IN MY POCKET” feature comes into play. Which is a combination of a cost tracker, a bill tracker, and a budget planner.

How much disposable income do you have left over after paying your bills. (A bill payment organizer will assist you in keeping track of your bills). Saving for your goals, and putting aside enough money for your needs and wants? (A bill payment organizer will assist you in keeping track of your bills.) PocketGuard, the budgeting app, takes care of all the computations! Always be aware of the current safe-to-spend number so that you can incorporate it into your monthly budget.

Other Features of the App

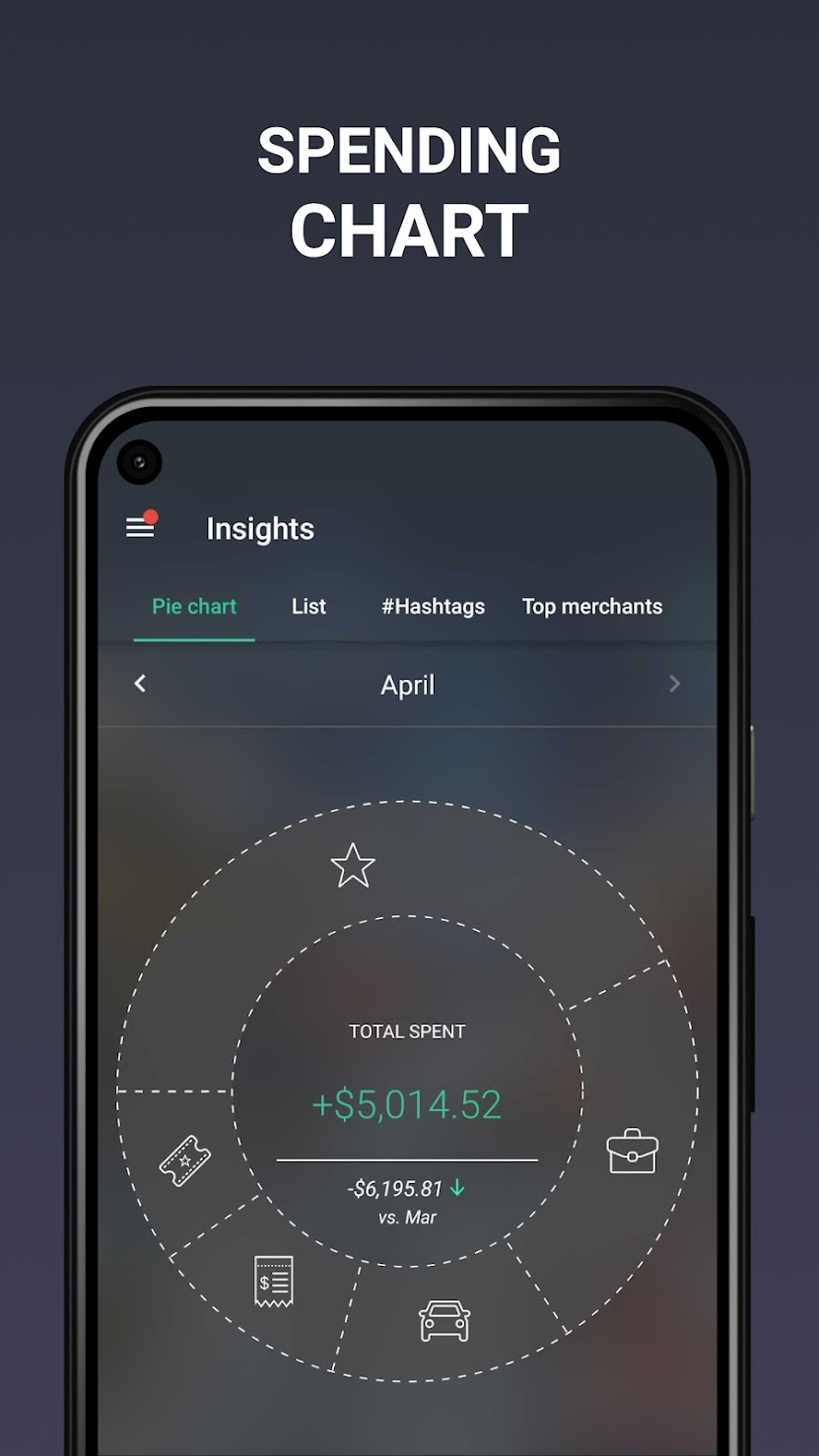

Analytical depth and breadth! The budget and cost tracker are only a fraction of the whole picture. Money management is a process that requires learning from the data that is collected. Pocket Guard “budgeting apps free” – provides you with a variety of reports. That allow you to view your personal finances from a variety of perspectives. Find out more about your spending habits, make any necessary adjustments, and optimize your monthly budget. It just might become your favorite budget planner!

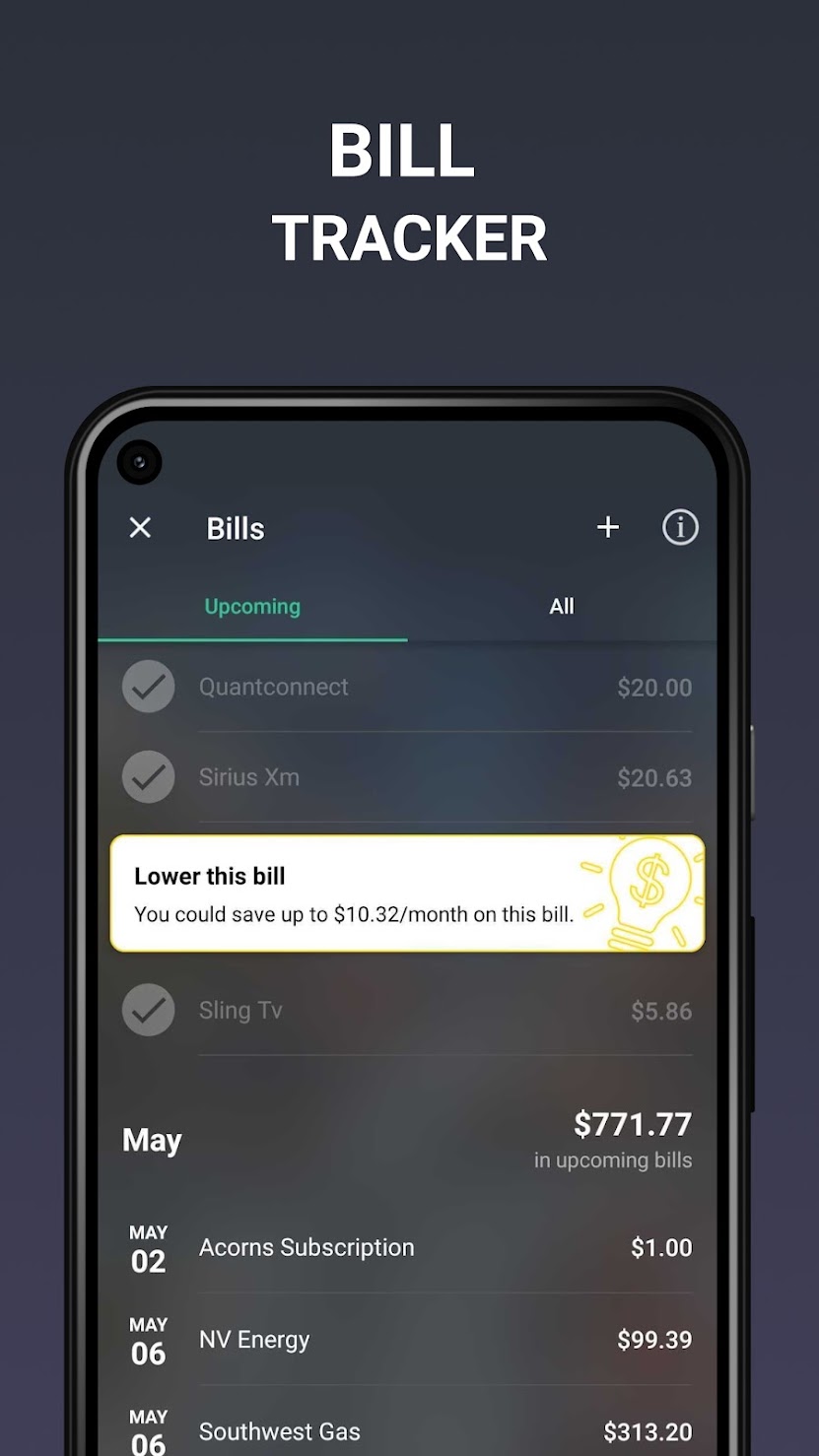

Bill tracker and subscription manager – all in one convenient place. Pocket Guard can be used to keep track of your bill payments. In addition to serving as a budget app, the PocketGuard finance tracker software. It also serves as a bank account connector. All of your bills and subscriptions will be detected and incorporated. In your monthly budget on a computerized schedule. The bill organizer will ensure that you never again forget when a bill is due.

Do you want to save money on your utility bills? That is, of course, what you do! PocketGuard’s bill organizer makes it simple to negotiate better rates. With your service provider and save money. As a result, you can reduce the amount of money you spend on services that you use to optimize your budget. Pocket Guard’s subscription manager will assist you in locating any subscriptions. That you may have forgotten about or cancelled. Another money-saving tip is to quit paying for services that you no longer require or want.

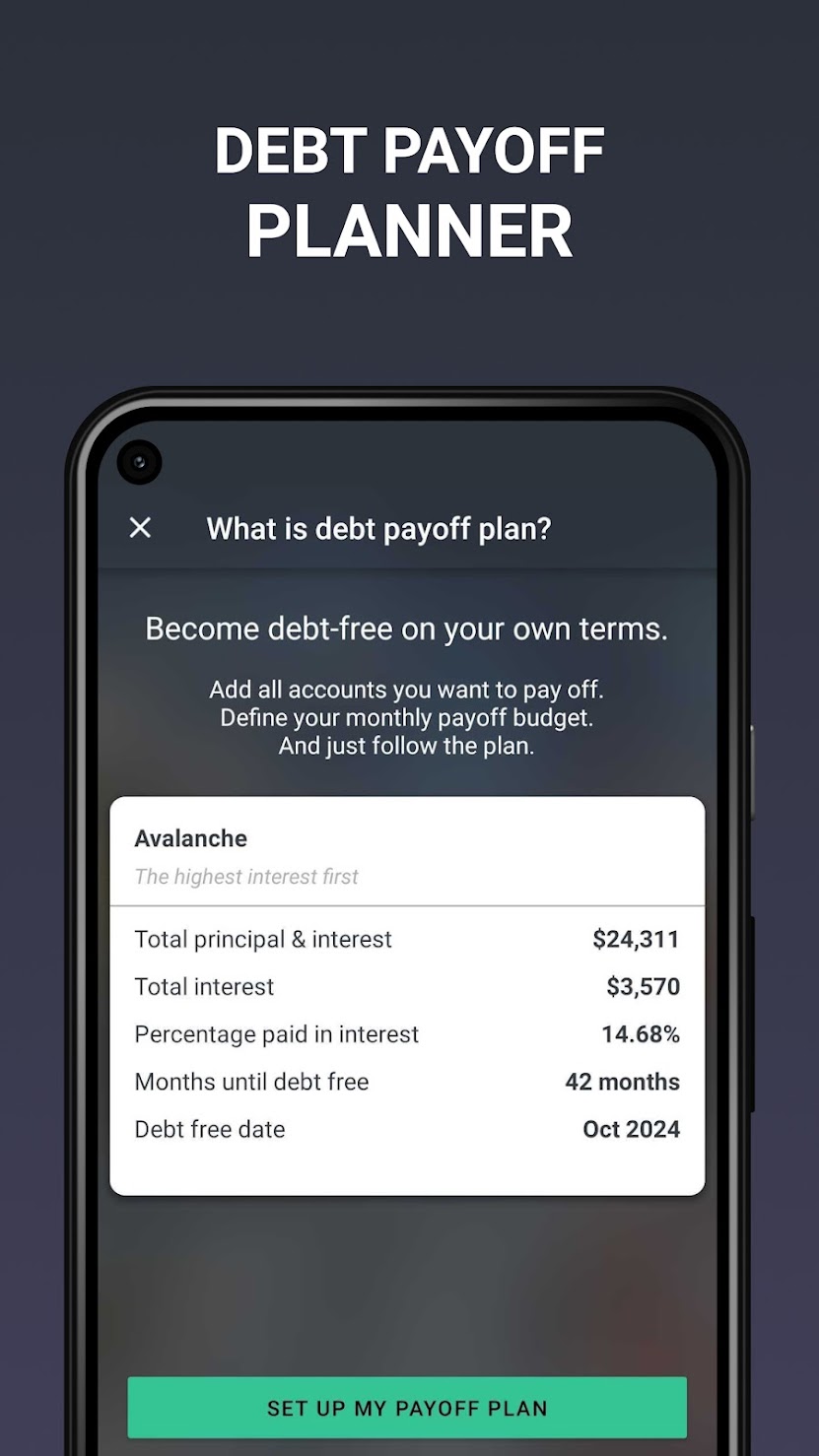

Set and achieve your financial objectives! Budgeting is built around the concept of goals. As previously said, the spending tracker app is only a small part of the whole picture. Personal finance is comprised of a set of objectives.

Reviews

There are no reviews yet.